Florida has long been a favorite destination for those hoping to escape the harsh winters. However, there are some things that new arrivals to the Sunshine State should be aware of before they arrive. Mainly Florida property insurance rates. Florida property insurance rates are the highest, devastatingly impacting the economy and homeowners’ budgets. However, homeowners consider that Florida’s overall reputation has always been a place for relatively low-cost living. In addition, the exorbitant rates are causing many to wonder if they should consider the move.

Lack Of Claims Does Not Matter

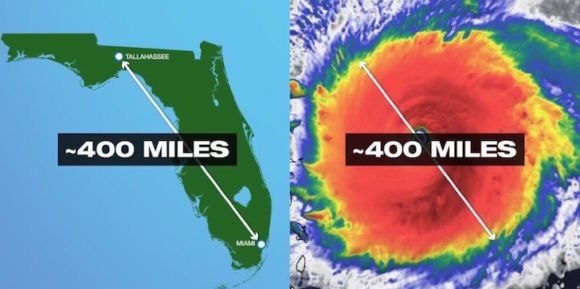

Florida homeowners have been pretty lucky about the lack of devastating hurricanes in the past couple of years, but this has not stopped a steady increase in Florida property insurance rates. In the last year, state regulators saw rate increase requests climb by nearly 70%, forcing them to consider why these rates are so high.

Considerations

When determining the cost of insurance rates in Florida, it is essential to understand that a wide range of policies covers the state of Florida. In addition, various risks across the state mean that when the averages are determined, carriers combine areas of low crime and weather threats and those with considerably higher threat levels. The result is a somewhat skewed view of the actual property insurance rates in areas not considered high-risk.

How Rates Are Determined

Companies determine FL property insurance rates from the location of the house. In addition, they evaluate the potential risk of the insurance companies having to pay a claim. Considering the rapid growth of coastal areas, where there […]